Discover the insider secrets to successfully sponsoring NYC condo projects and maximizing your investment potential in the bustling market.

Table of Contents

Introduction to Sponsoring NYC Condo Projects

We’ll start by explaining what it means to sponsor new condo projects in New York City. Kids, imagine being a superhero for a building – that’s kind of like what a sponsor does!

Understanding the Role of a Sponsor

Have you ever wondered what a sponsor does when it comes to building new condo projects in NYC? Well, let’s explore the exciting world of sponsors and how they help create amazing places for people to live!

What Does a Sponsor Do?

A sponsor is like the mastermind behind building a new condo. Imagine them as the architect, designer, and builder all rolled into one! Their job involves planning every detail of the new condo, from how many floors it will have to what color the walls will be. They make sure everything is just right so that people will love living there.

The Importance of a Sponsor

Sponsors play a crucial role in making new condo developments a reality. Without them, there wouldn’t be any new and exciting places for people to call home. They are like the superheroes of the construction world, working hard to create beautiful spaces for everyone to enjoy.

The Steps to Sponsor a New Condo

Next, we’ll walk through the adventure of sponsoring a new condo from start to finish.

Image courtesy of www.linkedin.com via Google Images

Finding the Perfect Spot

Imagine picking the best spot to build a new condo, like finding the perfect place for a secret hideout. Sponsors search for just the right location where people will love to live. They look for places with easy access to cool stuff like parks, schools, and shops.

Design and Planning

After finding the spot, sponsors get to let their imagination run wild. It’s like drawing a blueprint for a super cool treehouse. They decide how many floors the condo will have, what the rooms will look like, and even what colors to paint the walls. It’s all about making a beautiful place for people to call home.

The Building Begins

Once the plans are set, it’s time to start building the condo. Picture a huge team of builders and machines working together like a puzzle. They stack bricks, put in windows, and create all the rooms we’ll live in. It’s like watching a giant puzzle come to life!

Calculating the Cost

Building a condo is like putting together a giant puzzle, but it also costs a lot of money. Sponsors have to figure out how much everything will cost – from the materials to the workers’ wages. It’s a big job to make sure they have enough money to finish the project and create amazing new homes for people to live in.

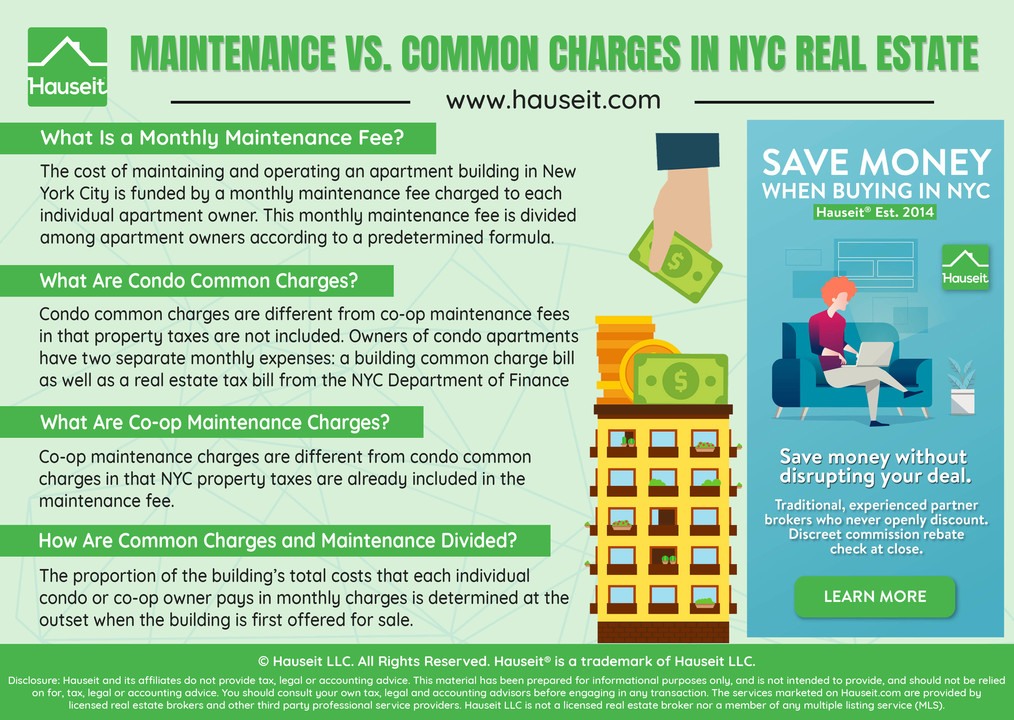

Key Considerations for High-Cost Real Estate Investments in NYC

Investing in New York City real estate can be both lucrative and challenging. Before diving into such a significant investment, it’s essential to reflect on several critical factors:

Financial Assessment

- Budget Analysis: Clearly define your budget. Consider the total cost, including purchase price, taxes, legal fees, and potential renovations.

- Upside Potential: Research the historical and projected appreciation rates in the area to understand the potential return on investment.

Market Research

- Neighborhood Trends: Study the real estate trends specific to the neighborhood. Different areas of NYC can vary widely in terms of price movements and demand.

- Rental Yield: For those considering rental properties, analyze average rental yields. This will help gauge the potential income you might generate.

Risk Management

- Legal and Regulatory Factors: NYC has complex zoning laws and building codes. Familiarize yourself with these to avoid unexpected legal challenges.

- Economic Fluctuations: Consider the broader economic conditions, as they can affect property values and rental income.

Resources and Expertise

- Engage Professionals: Consult with real estate agents, financial advisors, and legal experts familiar with NYC‘s market to make informed decisions.

- Backup Plans: Develop a strategy for worst-case scenarios, such as economic downturns or unexpected property maintenance issues.

Analyzing these factors thoroughly before committing to a high-cost real estate investment can guide you toward making a well-informed and strategic decision.

When considering real estate investments in New York City, the average annual appreciation rate stands at approximately 6%. This means that, on average, property values increase by 6% each year.

To put this into a longer-term perspective, if you had invested 10 years ago, your property’s value would have appreciated by around 79.16% cumulatively. Such robust growth highlights the potential profitability of investing in this dynamic market.

In summary, New York City‘s real estate market offers attractive returns, making it a compelling choice for investors seeking both annual growth and substantial long-term gains.

What is a Turnkey Property and How Does it Benefit Real Estate Investors?

A turnkey property is a ready-to-go piece of real estate designed for investors who want to dive into the rental market with minimal hassle. These properties are fully refurbished, meet rental standards, and often come with a tenant already in place. This setup allows investors to purchase the property and start earning rental income almost immediately.

Benefits for Real Estate Investors:

- Instant Income Potential: One of the most significant advantages is the ability to start generating rental income right after purchase. There’s no waiting period for renovations or finding tenants.

- Minimal Hassle: Turnkey properties are a boon for busy investors or those looking to enter the real estate market without getting bogged down in the nitty-gritty of property management. The properties are often managed by specialized companies that handle maintenance, repairs, and tenant relations.

- Geographical Flexibility: They represent an excellent opportunity for investors who wish to invest in lucrative markets, such as New York City, without needing to live nearby. This expands the investment horizon beyond local boundaries, allowing for a diverse portfolio.

- Professional Management: Although employing a property management company may incur additional costs, these services can significantly ease the burden of managing a property, ensuring smooth operations and freeing investors from day-to-day responsibilities.

In summary, turnkey properties are ideal for investors seeking a streamlined entry into the real estate arena. They offer a hassle-free investment with immediate income potential, especially attractive for those wanting to invest in high-demand urban areas without being physically present.

Buying Your Very Own New Condo

For those who dream of having their very own home in a brand-new building, buying a new condo can be an exciting adventure. In this section, we will guide you through the process of purchasing a condo in a newly constructed building in Manhattan.

Choosing the Right Condo

When it comes to buying a new condo, the first step is to choose the one that suits you best. Imagine walking into a magical world of different condos, each with its unique features and designs. Think about what you need in a home – from the number of bedrooms to the view from your window. Pick the condo that makes your heart happy!

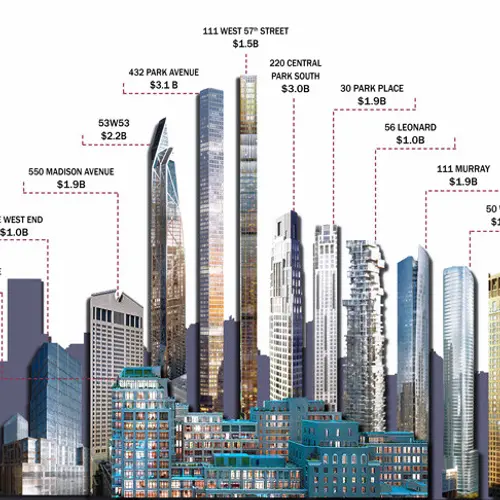

| Project Name | Location | Developer | Estimated Cost |

|---|---|---|---|

| Central Park Towers | Midtown Manhattan | Related Companies | $3 billion |

| One Manhattan Square | Lower East Side | Extell Development | $1.87 billion |

| 15 Hudson Yards | Hudson Yards | Related Companies | $1.25 billion |

| Brooklyn Point | Downtown Brooklyn | Extell Development | $900 million |

The Buying Process

Once you’ve found the perfect condo, it’s time to make it yours. Buying a new condo involves some steps, like putting together a puzzle. You’ll need to sign paperwork, make a payment, and work with real estate professionals who will help you along the way. Before you know it, that beautiful condo will be yours to enjoy!

How Does Buying Property Directly in New York City Differ from Other Investment Methods?

Investing directly in New York City‘s real estate sets itself apart from other methods due to its distinct challenges and requirements. Unlike other investment avenues, purchasing property outright often involves navigating a competitive market with high demand. This can make direct acquisition both cost-prohibitive and complex.

Key Differences:

- High Entry Costs: Acquiring property directly typically requires a substantial capital outlay. Investors must be prepared for higher upfront costs compared to other forms of investment, like real estate investment trusts (REITs) or real estate crowdfunding platforms, which allow for smaller initial investments.

- Regulatory Hurdles: New York City‘s real estate market is notorious for its stringent regulations and unique zoning laws. Direct buyers must contend with these requirements, which can be more demanding than those faced by investors using alternative methods.

- Intense Market Competition: The city’s property market is highly sought after, leading to intense competition among buyers. This competitive environment demands that investors act swiftly and decisively, a stark contrast to more passive investment methods.

- Control and Responsibility: Direct property owners have full control over their investment. This contrasts with other methods where management is often handled by third parties. However, with control comes the responsibility of managing the property, including maintenance, tenant relations, and compliance with local laws.

In summary, purchasing property directly in New York City offers potential rewards but requires navigating a landscape filled with financial, regulatory, and competitive challenges. This path demands a more hands-on approach and a readiness to address the unique hurdles the city presents.

Understanding How REITs Facilitate Investment in NYC Real Estate

Real estate investment trusts (REITs) offer a streamlined avenue for both local and international investors aiming to tap into the lucrative real estate market of New York City. Through a REIT, investors can collectively pool their resources to gain a stake in either commercial or residential properties, extending even to mortgage loans.

Special Focus on NYC’s Commercial Treasures

What sets New York City REITs apart is their dedicated focus on high-profile commercial and retail properties. Iconic locations such as Grand Central Terminal and Union Square are prime examples of the types of prestigious properties found within these investment portfolios.

Accessibility and Income Potential

Functionally, REITs operate similarly to stocks, allowing investors to buy shares that represent ownership in a diversified assortment of property holdings. A significant benefit of investing through REITs is the potential for regular dividend income. These trusts are required to distribute 90% of their taxable income as dividends, ensuring investors receive a steady flow of returns.

Benefits and Risks

- Dividend Income: Investors are rewarded with regular payouts, making REITs an attractive option for those seeking income generation.

- Diversification: By investing in a REIT, individuals gain exposure to a wide array of properties, minimizing risk associated with a single property investment.

However, it’s essential to recognize the potential risks. For instance, REITs may be sensitive to rising interest rates, which can influence both the real estate market and the value of dividends.

Overall, REITs offer a robust mechanism for engaging with New York City’s vibrant real estate scene, providing both stable income opportunities and the chance to participate in some of the city’s most prestigious property investments.

Manhattan’s Magic: New Condo Wonderland

We’ll dive into why new condos in Manhattan are so special, like a magical kingdom of homes.

Image courtesy of www.6sqft.com via Google Images

Image courtesy of www.6sqft.com via Google ImagesExploring Manhattan New Constructions

Manhattan, the heart of New York City, is buzzing with new condo buildings going up left and right. These are not your average buildings – they are sleek, modern, and designed to amaze. Imagine walking down the streets of Manhattan and seeing these beautiful structures reaching up towards the sky like giant Lego towers.

Why Manhattan?

So, what makes Manhattan the ultimate place for new condos? Well, for starters, it’s a hub of excitement and culture. From Broadway shows to Central Park, Manhattan has something for everyone. People dream of living in Manhattan because it’s where dreams come true. And now, with these new condos sprouting up, more and more people can call this amazing place home.

Key Considerations for Investing in New York City Real Estate

Investing in New York City real estate offers promising opportunities, but it’s essential to navigate through various critical factors to maximize your potential for success.

Understand the Competitive Landscape

Entering the city’s real estate market means competing with numerous seasoned investors. It’s crucial to set yourself apart with a well-researched strategy and prompt decision-making. Identifying emerging neighborhoods or untapped market opportunities can give you a competitive edge.

Evaluate Rental Dynamics

When assessing potential properties, focus on the rental income potential. Unlike other markets where size might be a primary consideration, in New York City, the number of bedrooms significantly influences rental prices. Be sure to carry out a thorough analysis to understand how these dynamics affect profitability.

Consider the Area

The neighborhood you choose can impact maintenance requirements and tenant turnover. Typically, lower-income areas may demand more resources for upkeep and experience higher tenant turnover rates. Balancing property costs and maintenance expenses is vital for long-term financial planning.

Financial Viability

Carefully compare the property’s purchase price with the expected rental income. This comparison is crucial to avoid over-leveraging yourself. Ensure that potential earnings can sustain the mortgage and other associated costs, helping you maintain a healthy cash flow.

Strategic Planning and Timing

Success in this vibrant market often hinges on the ability to act swiftly and strategically. Having a solid plan and financial resources ready will enable you to capitalize on potential opportunities quickly.

New York City’s real estate market is dynamic and offers substantial rewards for those prepared to assess these factors rigorously. By thoroughly understanding these elements, you can position yourself to make informed and lucrative investment decisions.

Exploring Top Investment Strategies in New York City Real Estate

Investing in New York City real estate can be a lucrative venture, but it’s crucial to navigate the market smartly. Here are some standout strategies to consider:

Key Insights

- New York City‘s real estate is renowned for its high cost, but it offers unique investment avenues.

- Options like turnkey properties and REITs make it accessible even for those not residing in the city.

- Direct property purchases, while challenging, can yield significant returns over time.

1. Opt for Turnkey Properties

For investors who wish to dive into the NYC market without managing renovation projects, turnkey properties provide an ideal solution. These are pre-renovated properties that can be rented out immediately. Specialized companies facilitate the sale of these ready-to-go buildings, giving non-residents a chance to partake in the lucrative New York market without the hassle of management.

2. Consider Real Estate Investment Trusts (REITs)

For a hands-off approach, REITs serve as a practical alternative. These trusts pool money from multiple investors to purchase and manage real estate assets, providing a way to benefit from the market’s growth. This strategy allows both local and global investors a slice of New York property without the heavy lifting of buying and managing properties directly.

3. Direct Property Acquisition

Purchasing property outright in New York City can be daunting due to the high prices and fierce competition. However, owning real estate here can be rewarding. It requires significant capital and savvy navigation through the city’s intricate market dynamics, but the long-term potential makes it an enticing option for serious investors.

By choosing the right investment strategy, you can tap into the vibrant NYC real estate market and potentially achieve noteworthy returns.

What is the Average Rent for Different Types of Apartments in New York City?

When considering the cost of living in New York City, understanding the average rents for various apartment types is crucial. Here’s a detailed look:

- Studio Apartments: On average, renting a studio in this bustling city will set you back approximately $4,050 per month.

- One-Bedroom Apartments: For those needing a bit more space, the cost rises, with one-bedroom apartments averaging around $4,997 monthly.

- Two-Bedroom Apartments: If you’re looking at two-bedroom units, prepare to budget roughly $7,573 each month.

These figures reflect the high demand and premium placed on living in one of the most dynamic urban environments in the world.

Wrapping It Up: Becoming a Super Sponsor

To become a super sponsor for NYC condo projects, you need to channel your inner superhero and be ready for an exciting adventure. Sponsoring new condo developments in New York City is a big responsibility, but with the right skills and mindset, you can make a real difference in creating amazing places for people to live.

What Does a Sponsor Do?

As a sponsor, your job is like being the mastermind behind a building project. You get to plan every detail, from the design of the condos to the amenities that will make residents feel at home. It’s a super important role that requires creativity, vision, and a passion for creating beautiful spaces.

The Importance of a Sponsor

Sponsors play a crucial role in bringing new condo developments to life. They provide the vision, resources, and expertise needed to turn an empty lot into a vibrant community. Without sponsors, many of the amazing buildings we see in the city wouldn’t exist, making them true heroes of the real estate world.

FAQs: Your Questions Answered

What Does a Sponsor Do?

A sponsor is like the superhero of a building project. They are in charge of planning and making sure the new condo is a fantastic place to live. Just like a superhero saving the day, a sponsor saves the building by overseeing everything from design to construction.

The Importance of a Sponsor

A sponsor is incredibly important for people who want to buy a new condo. They make sure the building is safe, beautiful, and meets all the rules. Without a sponsor, the new condo wouldn’t be able to become a reality, so they play a crucial role in bringing these wonderful spaces to life.

Begin your search and start earning cash back!

Is Investing in New York City Real Estate Considered Profitable?

Investing in New York City real estate can indeed be a lucrative venture for many. As a bustling metropolis that stands at the confluence of finance, culture, and global influence, NYC offers a compelling environment for property investments. Here’s why:

- High Appreciation Rates: Properties in NYC have historically shown strong appreciation, with the city’s ever-growing demand for housing contributing to rising property values.

- Rental Demand: The city’s diverse population, with a constant influx of professionals, students, and tourists, ensures a continuous demand for rental properties. This demand can translate into significant rental income for property owners.

However, entering the New York City real estate market comes with its challenges. The cost of entry can be steep given the premium pricing of properties here. Additionally, navigating the local market requires a thorough understanding of:

- Property Taxes and Regulations: New York City’s real estate laws and taxes can significantly impact profitability. Familiarity with these aspects is crucial.

- Real Estate Market Dynamics: The market in NYC is dynamic and can be influenced by various factors like economic shifts, interest rates, and urban development trends.

- Risks and Profit Potential: Like any investment, real estate in NYC carries risks. However, with careful research and strategic purchase decisions, many investors find the potential rewards worth the risk.

In summary, while the New York City real estate market can be challenging to penetrate, its historical propensity for appreciation and strong rental yields make it a potentially profitable investment. As always, due diligence and a clear understanding of the market’s intricate dynamics are essential for success.

How to Invest in New York City Real Estate Remotely

Investing in New York City real estate is possible even if you don’t reside in the area. Here’s how you can do it:

- Turnkey Properties: These properties are fully renovated and ready for tenants. By purchasing a turnkey property, you can start earning rental income quickly without the need to live nearby. Professional property managers can handle day-to-day operations, ensuring your investment runs smoothly.

- Property Management Services: If you already own property in NYC, hiring a property management company can be a game-changer. They take care of tenant relations, maintenance, and other operational details, so you don’t have to be directly involved.

- Real Estate Investment Trusts (REITs): For those who prefer a hands-off approach, REITs offer an excellent opportunity. These trusts pool together funds from various investors to purchase and manage properties. You can purchase shares in residential or commercial properties, gaining exposure to the lucrative NYC market without physical ownership.

Using these methods, investors can efficiently tap into New York City’s real estate market without the need to establish residency.

What are some specific REITs that focus on New York City real estate?

Investing in New York City’s real estate market can be quite attractive, and Real Estate Investment Trusts (REITs) offer a convenient way to do so. These trusts provide investors the chance to gain exposure to prime properties without the hassle of direct ownership.

When it comes to REITs with a heavy focus on New York City, several notable names come to mind:

- Vornado Realty Trust: Known for its office and retail properties, Vornado has a strong presence in the bustling areas of the city.

- SL Green Realty Corp.: As one of the largest office landlords in Manhattan, SL Green specializes in acquiring and managing commercial properties.

- Paramount Group, Inc.: This REIT is recognized for its top-tier office buildings located in key urban markets, including New York City.

- Empire State Realty Trust: Famous for owning the iconic Empire State Building, this trust invests in prime office and retail spaces throughout the city.

These REITs make it easier for individual investors to tap into the lucrative New York City real estate market, providing opportunities for both local and international stakeholders.

What Are the Potential Risks Associated with Investing in REITs?

Investing in Real Estate Investment Trusts (REITs) offers various advantages, but it’s crucial to be aware of the associated risks to make informed decisions.

Interest Rate Sensitivity

One of the primary risks of investing in REITs is their sensitivity to interest rate changes. When interest rates rise, REITs often experience declines in value. This happens because higher rates can increase borrowing costs for real estate projects and make other investments, like bonds, more attractive in comparison.

Market Volatility

Like stocks, REITs are traded on major exchanges and are subject to market fluctuations. Economic shifts or downturns in the real estate sector can negatively impact REIT prices, leading to potential losses for investors.

Economic and Real Estate Market Conditions

Broader economic conditions can significantly affect REIT performance. Factors such as unemployment rates, changes in consumer spending, or downturns in specific real estate sectors, like commercial or residential markets, can all influence REIT returns.

Regulatory Risks

REITs must comply with specific regulations, including distributing at least 90% of their taxable income as dividends. Any changes in tax laws or regulations that affect real estate investments can impact their profitability and the dividends paid out to investors.

Concentration Risks

Investors should be mindful of REITs that concentrate heavily in particular property types or geographical areas. Economic challenges in a specific industry or region could severely impact a REIT’s performance, reducing diversification benefits.

By understanding these risks, you can better navigate your investment strategy and manage potential challenges that come with investing in REITs.

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach.

Our Comprehensive Services Include:

- Search Apts for Sale: Explore a wide range of available properties tailored to your preferences.

- Market Reports: Stay informed with the latest market trends and data to make educated decisions.

- Buyer’s Guide: Navigate the buying process with ease using our detailed guide.

- Find an Agent: Connect with experienced agents who understand your needs and local market intricacies.

- Market Data: Access comprehensive data to inform your buying or selling strategy.

- Selling Your Apartment: Receive expert advice and strategies to ensure a successful sale.

Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions.

Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

- What support is available for selling my apartment?

There is targeted assistance available for those looking to sell their apartments, ensuring you have the resources and support needed for a successful transaction.

- How can I find a real estate agent?

Utilize services that connect you with experienced real estate agents who can help you navigate the buying or selling process.

- Is there guidance available for buyers?

Yes, there is a dedicated buyer’s guide available that offers valuable information and tips to assist you throughout the purchasing process.

- What resources are available to understand the market?

Access comprehensive market reports and data that provide insights into current trends and conditions, helping you make informed decisions.

- How can I search for apartments for sale?

You can explore available properties through specialized search tools designed to help you find the perfect apartment for sale.

Image courtesy of via

Image courtesy of via