Discover the secrets to successfully financing coops in the competitive NYC property market and how to navigate the process effectively.

Table of Contents

Introduction to Financing Coops in NYC

Looking to find your dream home in the bustling city of New York? Well, you’ve come to the right place! Today, we are going to embark on a journey to understand the ins and outs of financing coops in the vibrant real estate market of New York City.

What is a Coop?

Before we dive into the world of financing co-ops, let’s first understand what a co-op actually is. A co-op, short for cooperative, is a unique type of home ownership where residents own shares in a corporation that owns the building. Each resident has the right to occupy a unit in the building based on the number of shares they own. It’s like being part of a big family where everyone pitches in to maintain the building and make decisions together.

A Community Like No Other

Beyond the shared financial responsibilities, co-ops create a vibrant sense of community that sets them apart from other living arrangements. The vetting process for potential buyers is strict, ensuring that those who join the co-op are a good fit for the community. This careful selection contributes to a stable and cohesive environment.

Unlike condo buildings, which may feel impersonal with a rotating cast of residents, co-ops encourage familiarity. You’re less likely to encounter a new face every day, as residents tend to stay for the long haul. This consistency allows you to truly get to know your neighbors, seeing them regularly in shared spaces and meetings.

Security Through Familiarity

This closeness also brings an added layer of security. In co-ops, residents are more vigilant about who enters the building. A strange face won’t go unnoticed, making it easier to maintain a safe and secure environment. This mutual watchfulness fosters trust and reinforces the sense of community among co-op members.

By living in a co-op, you’re not just buying a home; you’re gaining a community that values both connection and security.

1. Why might co-ops be considered friendlier than other types of housing?

Co-ops often provide a warmer, less impersonal atmosphere compared to condos, as the regular interactions and recognition among residents contribute to a friendlier environment.

2. What are the security benefits of living in a co-op community?

The familiarity among co-op residents enhances security, as people are more likely to notice unfamiliar faces or potential intruders, which is less common in anonymous housing environments.

3. How do co-op residents interact differently compared to those in other types of housing?

In co-ops, residents are more likely to see and recognize each other frequently, leading to stronger neighborly connections, unlike in environments where there is a high turnover of occupants.

4. How does the resident selection process affect community dynamics?

Co-ops implement a thorough vetting process for potential buyers, which contributes to a stable and cohesive community of residents who are carefully chosen, fostering a sense of belonging and investment in the community.

Why are Coops Unique in NYC?

Coops are particularly popular in New York City because of the way the property market is structured. Due to historical reasons and strict regulations, coops make up a substantial part of the real estate landscape in the city. They tend to be more affordable than traditional condos and offer a sense of community living that many New Yorkers appreciate.

Why are co-ops generally cheaper than condos? Several factors contribute to this affordability:

- Building Age: Co-ops are often housed in older buildings compared to condos. This typically means they lack the latest technology and amenities found in newer constructions, which is reflected in their lower cost.

- Lower Closing Costs: When purchasing a co-op, buyers benefit from lower closing costs. Unlike condos, co-ops do not require extensive title insurance, taxes, and fees. For instance, closing on a Manhattan co-op priced under $1 million can cost between $5,000 and $8,000, whereas a condo averages around $20,000 in closing costs.

This cost-efficiency, along with the inherent community feel, makes co-ops an attractive option for many city dwellers.

1. How do the structural differences between co-ops and condos affect their costs?

Since a co-op is not considered a physical piece of property in the same way a condo is, this impacts the associated costs, making co-op purchases less expensive.

2. What contributes to the lower closing costs of co-ops compared to condos?

Co-op purchases have fewer requirements for title insurance, taxes, and fees, leading to significantly reduced closing costs compared to condos.

3. Why are co-ops generally less expensive than condos?

Co-ops tend to be older buildings that lack the modern technology and amenities found in newer condos, resulting in a cost that is 15 to 20 percent lower.

Understanding the Costs

Diving into the expenses of owning a coop in New York City can give you a clear picture of what to expect financially. Let’s break down the costs involved in purchasing and maintaining a coop.

Initial Purchase Price

When you decide to buy into a coop, you’ll need to consider the initial purchase price. This is the amount you will pay upfront to become a part-owner of the cooperative. The price can vary depending on the location, size, and amenities of the coop. It’s essential to budget accordingly and factor in additional costs like closing fees and legal expenses.

Monthly Maintenance Fees

Aside from the purchase price, coop owners also need to account for monthly maintenance fees. These fees cover the costs of maintaining the building, repairs, utilities, and other shared expenses. The amount of the monthly fees can fluctuate based on the coop’s financial health and ongoing maintenance needs. It’s crucial to include these fees in your budget planning to ensure you can comfortably afford to live in a coop.

Exploring New Developments

When it comes to finding a new place to call home in New York City, keeping an eye on the latest developments is key. Let’s take a closer look at the exciting opportunities that new condo developments in NYC and new construction in Manhattan offer for coop living.

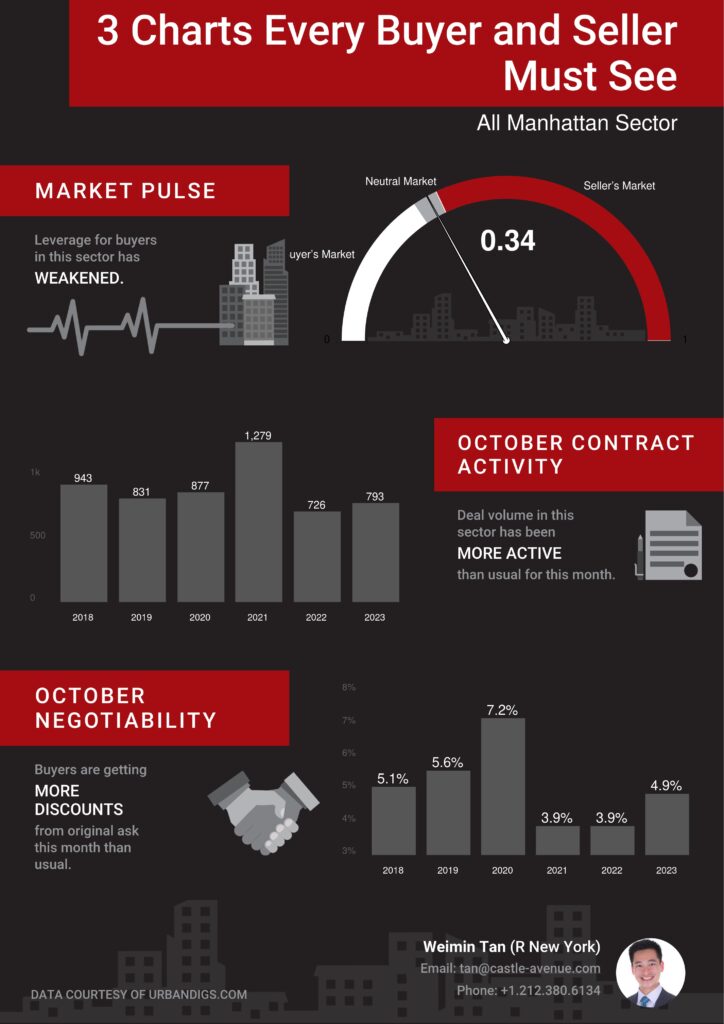

Image courtesy of www.castle-avenue.com via Google Images

What’s Trending in Manhattan

Manhattan is known for its vibrant neighborhoods and iconic skyline, and new condo developments continue to reshape the cityscape. From sleek high-rises with panoramic views to luxurious amenities like rooftop pools and fitness centers, there’s something for everyone in the Big Apple.

As neighborhoods evolve and new buildings rise, keep an eye out for upcoming projects that could be your next dream home. Whether you’re looking for a cozy coop in a historic brownstone or a modern condo in a bustling new development, Manhattan has options to suit every style and budget.

Comparing Coops to Condos

When exploring new developments in NYC, it’s important to understand the differences between coops and condos. While both offer the convenience of city living, coops typically come with a unique ownership structure that sets them apart from traditional condominiums.

Coop owners purchase shares in a corporation that owns the building, giving them the right to occupy their unit. Monthly maintenance fees cover building expenses, property taxes, and sometimes even utilities, making budgeting simpler for residents. On the other hand, condo owners own their individual units outright and are responsible for all maintenance costs.

Why Are Co-Ops Considered Financially Stable?

Co-ops possess a unique strength in financial stability, largely attributed to their ownership model. Instead of relying on external investors, co-op buildings are owned by the residents themselves. This sense of ownership fosters a collective responsibility among residents, making them highly selective about new members.

Co-op boards implement stringent entry criteria to ensure future members can handle the financial responsibilities. This vetting process goes beyond basic financial checks; potential shareholders often need to demonstrate the capacity to comfortably manage their financial commitments over the long haul. As a result, properties maintain consistent value and offer a level of financial security to their owners.

This financial robustness was particularly evident during periods of economic instability, such as the 2008 Great Recession. While the housing market nationwide faced severe challenges, areas rich in co-ops, notably New York, experienced a relative stability. This resilience was due to the rigorous lending standards and collective ownership structure, which significantly reduced the risk of mortgage defaults among co-op shareholders.

Co-ops, therefore, not only provide a stable investment but also contribute to a more resilient local real estate market, making them a safe haven for buyers seeking long-term security.

How Do Co-ops Provide More Inventory in NYC?

Navigating New York City‘s housing landscape can be overwhelming, but co-ops offer a significant advantage: an abundance of options. As early as the 19th century, co-ops began establishing their presence in NYC. This early start lays the foundation for their prevalence today.

A Rich Historical Legacy

The history of co-ops means they are woven into the fabric of many of the city’s most admired buildings. Unlike condos, which didn’t gain popularity until the 1970s, co-ops are often found in iconic prewar structures. These buildings boast classic features such as ornate wood trims, elegant moldings, and stately beamed ceilings.

The Numbers Game

Co-ops dominate the market, comprising roughly 75% of the city’s housing stock. For prospective buyers, this results in a wealth of choices, offering everything from charming, historic townhouses to grand, architecturally significant residences.

By considering co-ops, buyers unlock access to the majority of available properties, increasing their chances of finding a perfect fit in the NYC real estate market.

Challenges of Modern Construction in Co-ops

Co-ops often find themselves housed in older buildings, which presents a unique set of challenges compared to newer constructions. One primary issue is maintaining these historic structures. While the strong and thick walls of older buildings are a testament to their solid construction, they are often accompanied by outdated systems.

For instance, an elevator untouched by modernization might still rely on antiquated systems, requiring substantial investment to ensure smooth and efficient operation. Similarly, aging heating systems, like old boilers, can be temperamental and costly to repair or replace.

Furthermore, these older buildings may come with drafty windows and less efficient insulation, which can result in increased utility costs and discomfort for residents. On the other hand, new condominium developments must comply with current building codes. This means they are equipped with modern mechanical systems, ensuring efficiency and reducing maintenance burdens.

In summary, while co-ops offer charm and robust construction, their maintenance demands can be more intensive and costly compared to the streamlined modern amenities found in newer condos.

Getting a Loan for a Coop

When it comes to buying a coop in New York City, most people need to borrow money to make their dream home a reality. Let’s explore how you can secure a loan for a coop and what you need to know about the process.

| Topic | Description |

|---|---|

| Financing options | Explore various financing options available for cooperatives in NYC, including traditional mortgages, co-op loans, and financing through specialized lenders. |

| Co-op financial health | Learn how to assess the financial health of a cooperative before investing, including reviewing financial statements, reserves, and maintenance fees. |

| Market trends | Stay informed on the current trends in the NYC property market, including pricing fluctuations, demand trends, and emerging neighborhoods. |

| Co-op regulations | Understand the regulations governing cooperatives in NYC, including resale restrictions, board approval processes, and common charges. |

Coop Loan Basics

A coop loan is a type of mortgage specifically designed for cooperative apartments. Unlike traditional mortgages for condos or houses, coop loans involve financing a share of a cooperative corporation rather than owning real property outright. This means that when you buy into a coop, you are buying shares in the cooperative corporation that entitles you to a proprietary lease for your unit.

When applying for a coop loan, lenders will consider the financial health of the cooperative as a whole, in addition to your personal financial situation. They will review the coop’s financial statements, reserve funds, and maintenance fees to assess the risk of lending to you. Keep in mind that coop loans may have different requirements and terms compared to conventional mortgages, so it’s crucial to work with a lender familiar with coop financing.

Tips for Securing a Loan

Here are some tips to help you increase your chances of securing a loan for a coop:

1. Improve your credit score: A higher credit score can make you a more attractive borrower and potentially qualify you for better loan terms.

2. Save for a larger down payment: Coop loans often require a larger down payment compared to traditional mortgages. Saving up more money upfront can help you meet this requirement.

3. Get pre-approved: Before starting your coop search, get pre-approved for a loan. This can show sellers that you are a serious buyer and speed up the closing process.

4. Work with a coop-savvy lender: Look for lenders who specialize in coop financing. They can guide you through the unique requirements and complexities of coop loans.

By understanding the basics of coop loans and following these tips, you’ll be well-equipped to navigate the loan process and secure the financing you need to purchase your dream coop in New York City.

Making the Move: Steps to Buying a Coop

When you’ve decided that living in a co-op in New York City is the right choice for you, it’s time to take the next steps towards owning your own piece of the Big Apple. Here are the key stages you’ll go through when purchasing a co-op:

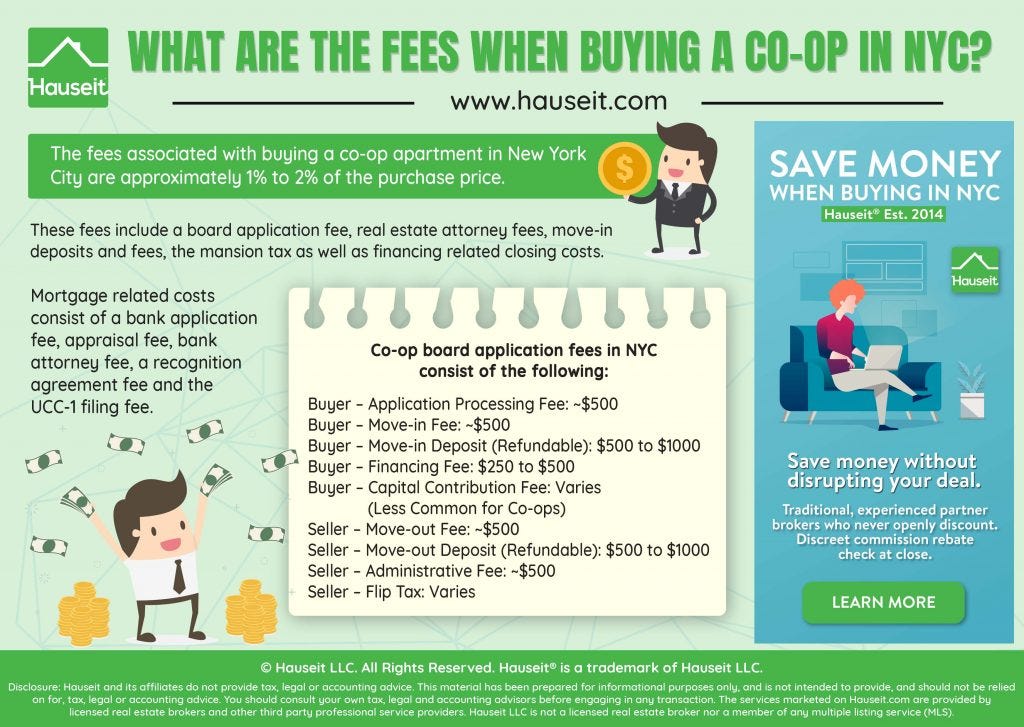

Image courtesy of hauseit.medium.com via Google Images

Image courtesy of hauseit.medium.com via Google ImagesFinding the Right Co-op

The first step in buying a co-op is finding the perfect one for you. You’ll need to consider factors like location, size, amenities, and price. Start your search by working with a real estate agent who specializes in co-ops in NYC. They can help you narrow down your options and find a co-op that fits your needs and budget.

Financial Preparation

Before you even start apartment hunting, it’s essential to consult mortgage lenders to get an idea of how much home you can afford. Typically, co-ops require a 20% to 30% minimum down payment, a low debt-to-income ratio, and high post-closing liquidity. Ensure you’re pre-approved for a mortgage, as this will streamline the process once you find a co-op you love.

Engaging Professionals

In addition to a real estate agent, find a real estate lawyer who can provide legal guidance throughout the purchase. If you don’t know any, ask friends and family for recommendations. Your agent can often recommend one as well.

Making an Offer

Once you’ve identified the ideal co-op, make an offer. If accepted, you’ll sign the contract. This is the time to negotiate any repairs or changes you want, such as removing a broken appliance or altering fixtures. Be prepared for some negotiation, as the seller may not accommodate all your requests.

Undergoing the Approval Process

One of the unique aspects of buying a coop in NYC is the approval process by the coop board. Once you’ve found a coop you like, you’ll need to submit an application to the board. They will review your financials, conduct an interview, and make a decision on whether to approve you as a potential shareholder in the coop. Be prepared to provide detailed financial information and references as part of this process.

While the level of detail required might seem excessive or even intrusive, there’s a crucial reason behind it. In a coop, financial stability is paramount because if one shareholder falls into debt, the entire building’s financial health is at risk. Everyone else must shoulder any loss in income, making it essential for the board to ensure that every potential shareholder is financially solid.

This detailed scrutiny acts as a safety net for all residents, fostering a sense of trust and security within the community. By thoroughly vetting applicants, the board aims to protect the building’s future and ensure that each new member can contribute positively to the coop’s collective well-being.

Closing and Moving In

If all goes well with your application and board interview, you’ll be cleared to set a date for closing. Once closed, you can move into your new home and start enjoying everything your NYC co-op lifestyle has to offer! Welcome to your new home!

Why Do Co-Op Boards Reject Applications?

Navigating the co-op application process is often challenging, mainly because the reasons for rejection can be as varied as they are obscure. Below are some common reasons why your application might not make the cut.

- Incomplete or Disorganized Application: Your application is your first impression. A sloppy or incomplete application could signal to the board that you might manage your finances poorly. Ensure that every document is in order, and don’t hesitate to seek clarification if you’re unsure about any part of the application process.

- Lacking Financial Stability: Co-op boards often scrutinize financial details meticulously. They might inquire about issues such as your debt-to-income ratio (DTI) and any financial obligations like alimony or child support. Consistently high credit card balances or irregular income can raise red flags. Demonstrating reliable financial habits is crucial.

- Offer Price Issues: Sometimes, the offer you’ve made for the unit may be considered too low by the board. This perception can negatively impact the building’s overall property value, prompting a rejection. Collaborate closely with your real estate agent to ensure your offer aligns well with the market value.

- Concerning Personal Behavior: The board may evaluate your lifestyle to determine if you would be a harmonious fit within the community. Frequent job changes, an active party lifestyle, or even a controversial social media presence can cause concern. Boards tend to favor applicants who appear stable and considerate of their prospective neighbors.

Applying for a co-op can be challenging, but being thorough and demonstrating financial reliability can make a significant difference. Prepare carefully, and you’ll be more likely to secure the home you want.

Understanding the Leverage Co-op Owners Have in Disputes

Co-op owners enjoy a unique advantage when it comes to resolving disputes, particularly when dealing with troublesome neighbors.

While condo dwellers often have limited recourse, co-op owners can rely on their cooperative board to enforce community guidelines. This board can impose penalties, such as fines, on shareholders who frequently infringe upon established rules.

And if the situation escalates, the co-op board has the authority to take more severe actions, like evicting a shareholder who fails to comply. This provides co-op owners with a powerful tool for maintaining a harmonious living environment.

This structured system ensures that co-op owners are not left without options, unlike their condo counterparts, who may have to handle conflicts independently.

Conclusion: Is a Coop Right for You?

After exploring the ins and outs of coops in New York City, you may be wondering if this type of housing is the right fit for you. Coops offer a unique way to own property in the city, but they also come with their own set of rules and considerations. Let’s take a moment to reflect on whether a coop is the right choice for your NYC housing needs.

Living in a coop can offer communal living with shared amenities and a sense of community. If you value a close-knit living environment and are willing to abide by the coop’s rules and regulations, then a coop might be a great option for you. It’s essential to consider your lifestyle and preferences before making a decision.

What Are the Disadvantages?

While coops have their appeal, it’s crucial to understand their downsides:

- Invasive Application Process: Be prepared for a co-op application to require every detail about your life. Many people find this off-putting, but it’s necessary to ensure financial stability for all shareholders because if one falls into debt, everyone else bears the burden.

- Older Construction: Coops are often older buildings. While this can mean sturdy construction, it also translates to potentially higher maintenance costs. For instance, outdated elevators or boilers might require significant capital to update.

- Limited Flexibility: Coops are less flexible than condos. Renting out your unit or lacking a stable employment history can be deal-breakers. Conversely, condos tend to have fewer restrictions, offering more freedom in terms of renovations and leasing.

- Longer Closing Times: Coops can take three to five months to close due to their detailed financial scrutiny. In contrast, condos tend to close faster, often within two months.

On the other hand, if you prefer more autonomy and flexibility in your living situation, a condo might be a better fit. Condos typically offer more freedom in terms of renovations and renting out your unit, which can be appealing to some buyers. Consider what aspects of homeownership are most important to you when weighing your options.

Why Co-ops Might Be Less Flexible

While condos provide this level of flexibility, co-ops often come with several restrictions that can feel limiting. For instance, if you’re looking to rent out your unit soon after purchase, co-ops usually won’t allow it. They’re also more selective about who they accept, requiring a stable employment history, good credit, and a cash reserve that can last for years.

In contrast, condos generally don’t have these stringent requirements. As long as you can manage the minimum downpayment and secure a mortgage, you’re typically good to go. This makes them a more accessible option for those who may not qualify for a co-op due to these financial and personal criteria.

1. How do co-op requirements compare to those of condos?

Co-op ownership typically involves more stringent conditions compared to condos. While co-ops demand a thorough financial vetting process, condos usually require just a down payment and mortgage approval.

2. What are the financial requirements for purchasing a co-op?

Purchasing a co-op often requires a strong financial background, including a consistent employment record, good credit, and a substantial cash reserve intended to last for several years.

3. Can I rent out my unit immediately in a co-op?

Generally, co-ops do not allow you to rent out your unit right away, making it less suitable for those looking to lease their property quickly.

Additionally, if you’re interested in new condo developments in NYC, coops may not always be the best choice. Condos often offer modern amenities and trendy features that may not be found in older coop buildings. If you’re looking for a sleek, contemporary living space, exploring new construction projects in Manhattan might be more aligned with your preferences.

Ultimately, the choice between a coop and a condo hinges on what you value most in a home and your willingness to navigate the inherent challenges of coop ownership.

Why Consider Buying a Co-Op Apartment?

Cost-Effective Choice

Co-op apartments are generally more affordable than condos. They tend to cost 15 to 20 percent less, primarily because they are often older buildings without the latest technology and amenities. Additionally, co-op closing costs are significantly lower. Unlike condos, co-ops do not require extensive title insurance or certain taxes, leading to considerable savings at closing.

Abundant Inventory and Historic Charm

In major cities, co-ops make up a substantial portion of the housing stock, offering more choices for potential buyers. Many co-ops are housed in beautiful old buildings with unique architectural features like decorative molding and beamed ceilings. This historical allure adds to the charm and appeal of co-op living.

Financial Stability

Co-ops are known for their financial stability. The residents, rather than outside investors, own the building, contributing to a vested interest in maintaining the property’s financial health. This stability was particularly evident during economic downturns, such as the 2008 recession, when co-ops maintained their value better than other real estate options.

Community and Security

Living in a co-op often means being part of a community where neighbors know each other, enhancing both the social experience and security. Familiar faces are more likely to notice any unusual activity, providing peace of mind for residents.

Effective Dispute Resolution

Co-ops offer more leverage in resolving disputes. For instance, if you encounter a noisy neighbor, the co-op board can enforce rules and even impose fines, providing more control over your living environment compared to a typical condo.

By considering these advantages, you can better decide if co-op living aligns with your lifestyle and housing needs.

Ultimately, the decision of whether a coop is right for you comes down to your personal preferences, financial situation, and lifestyle. Take the time to research and tour different properties, consult with a real estate agent, and weigh the pros and cons of coop ownership before making a decision. With careful consideration, you can find the perfect housing option that suits your needs and preferences in the bustling city of New York.

Frequently Asked Questions (FAQs)

FAQ1

What is the main difference between a coop and a condo in New York City?

In New York City, a coop is a type of housing where residents own shares in a corporation that owns the building, while a condo is more like traditional homeownership where you own your individual unit outright.

One key distinction is that coops typically require board approval for purchases and rentals, while condos have more flexibility in this regard.

FAQ2

How much does it cost to build a coop or condo in Manhattan?

The cost of building a coop or condo in Manhattan can vary greatly depending on the location, size, and level of luxury. On average, the cost of new construction in Manhattan can range from several hundred thousand dollars to millions of dollars.

This cost includes not only the construction of the building itself but also permits, land acquisition, design fees, and other expenses that are part of the development process.

Begin your search and start earning cash back!

Why Do Co-ops Take Longer to Close Compared to Condos?

When navigating the real estate landscape, you might wonder why purchasing a co-op often stretches out over a prolonged timeline in contrast to acquiring a condo. The answer lies in the rigorous vetting process that co-ops typically enforce.

Financial Diligence

Co-op boards prioritize financial stability. To protect the collective interests of the building, they thoroughly examine all prospective buyers’ financial situations. This diligence involves requesting an extensive array of documents, such as bank statements, tax returns, and asset disclosures.

Board Approval Process

Another layer of complexity in closing a co-op purchase is the board approval process. Each buyer must be vetted and approved by a co-op board, which can involve interviews and meetings. Scheduling and completing this process can add weeks, if not more, to the timeline.

Documentary Requirements

Unlike condos, co-ops have demanding documentation requirements. Buyers may have to provide additional paperwork beyond initial expectations as the board evaluates their application. This can lead to prolonged back-and-forth submissions, further extending the timeline.

The culmination of these stricter processes means that closing on a co-op might take between three to five months. In contrast, condos usually involve a more straightforward transaction process, often closing in under two months. This efficiency can make condos a faster, albeit occasionally more expensive, option for homebuyers.

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach.

Our Comprehensive Services Include:

- Search Apts for Sale: Explore a wide range of available properties tailored to your preferences.

- Market Reports: Stay informed with the latest market trends and data to make educated decisions.

- Buyer’s Guide: Navigate the buying process with ease using our detailed guide.

- Find an Agent: Connect with experienced agents who understand your needs and local market intricacies.

- Market Data: Access comprehensive data to inform your buying or selling strategy.

- Selling Your Apartment: Receive expert advice and strategies to ensure a successful sale.

Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions.

Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

- What support is available for selling my apartment?

There is targeted assistance available for those looking to sell their apartments, ensuring you have the resources and support needed for a successful transaction.

- How can I find a real estate agent?

Utilize services that connect you with experienced real estate agents who can help you navigate the buying or selling process.

- Is there guidance available for buyers?

Yes, there is a dedicated buyer’s guide available that offers valuable information and tips to assist you throughout the purchasing process.

- What resources are available to understand the market?

Access comprehensive market reports and data that provide insights into current trends and conditions, helping you make informed decisions.

- How can I search for apartments for sale?

You can explore available properties through specialized search tools designed to help you find the perfect apartment for sale.

Image courtesy of via

Image courtesy of via