Curious about the tax rates on new NYC condos? Find out everything you need to know in our comprehensive guide.

Table of Contents

Introduction: The Buzz About New Condos in NYC

Are you intrigued by the gleaming skyscrapers and bustling lifestyle of New York City? Well, hold onto your hats because we’re about to dive into the exciting world of new condo developments in the Big Apple! Today, we’re going to unravel the mystery behind why tax rates play a crucial role in these modern marvels. So, buckle up and get ready to explore the buzz surrounding new condo developments in NYC!

Chapter 1: What’s Up with Taxes on New NYC Condos?

When it comes to taxes on new condos in NYC, things can get a bit tricky. Have you ever wondered why the taxes on new construction condos are different from other properties? Let’s dig into the basics to understand why taxes on new NYC condos are higher.

A. Taxes and New Buildings

Imagine you’re building a brand-new LEGO set. It’s shiny, new, and everyone wants to play with it. Just like that LEGO set, new condos in NYC are fresh and appealing. Because they’re new and have all the latest features, the government thinks they’re more valuable. As a result, the taxes on new condos can be higher compared to older properties. So, when you see a gleaming skyscraper going up, remember that it may come with higher tax bills.

B. Comparing Old vs. New Condo Taxes

Now, let’s compare taxes on an old, creaky building with taxes on a fancy, new condo. The older building has been around for a while and might not have all the modern amenities that a new condo offers. This difference in value affects how much tax you have to pay. New condos often have higher property taxes because they’re seen as more valuable due to their newness and luxury features. It’s like buying a new toy compared to a used one—the brand new toy might cost more, and so do new condos in terms of taxes.

Chapter 2: The Cost of Building a New Condo in NYC

Building a new condo in New York City involves several significant costs. One of the first expenses to consider is the price of the land where the building will be constructed. In bustling areas like NYC, land prices can be incredibly high due to the high demand for real estate. Developers must secure a suitable plot of land, which can be a substantial investment.

Image courtesy of blocksandlots.com via Google Images

Additionally, the construction costs of a new condo in NYC are considerable. This includes the expenses involved in hiring architects, engineers, construction workers, and obtaining the necessary permits. High-quality materials and modern amenities also contribute to the overall cost. All these factors add up to make building a new condo in NYC a pricey endeavor.

B. How Building Costs Affect Taxes

The cost of building a new condo in NYC directly impacts the property taxes that owners will have to pay.

Since property taxes are calculated based on the assessed value of the property, which includes the land and building, the higher the construction costs, the higher the assessed value will be. But how exactly are these assessments and calculations made?

To gain a complete understanding of how your property’s assessment and tax bill are determined, consider the following key points:

- Market Value: Assessors estimate the property’s fair market value, which is what it would likely sell for under normal conditions.

- Assessment Ratio: This is a percentage of the market value that is taxable. The ratio varies depending on the jurisdiction.

- Exemptions and Deductions: Certain exemptions may apply, reducing the taxable amount. These could include homestead exemptions or deductions for senior citizens.

For a deeper dive into these factors, you may want to consult resources that detail the assessment process, ensuring you’re aware of what influences your property’s assessed value and, ultimately, your tax bill.

Understanding these components can help you anticipate changes in your property taxes and plan accordingly.

1. Where can I find detailed guidance on property tax assessment and calculation?

Detailed information on property tax assessment and calculation is typically available through local government resources or the official website of the tax assessment office, where you can learn about methodologies and get guidance specific to your area.

2. How does the assessment process affect the final tax bill?

The assessment process directly impacts the tax bill by determining the base value upon which the tax rate is applied. A higher assessed value results in a higher tax obligation.

3. What factors are considered in calculating property taxes?

Property taxes are calculated based on the assessed value, which includes both land and building values. Other factors might include local tax rates and any applicable exemptions or deductions.

4. What methods are used to assess the value of a property?

Property assessments typically involve a comprehensive evaluation of various factors including the property’s location, size, and features. Appraisers may also consider recent sales of comparable properties in the area to determine the assessed value.

This, in turn, leads to higher property taxes for owners of new condos.

How Are My Tax Dollars Distributed Across City Services?

Understanding where your tax dollars go can often feel like unraveling a mystery, but it’s crucial to grasp how these funds facilitate city operations. Let’s break it down clearly.

Property Tax’s Role

In recent fiscal periods, nearly half of the city’s tax revenue—44% to be precise—was derived from property taxes. This significant source of income fuels essential public services and initiatives across various sectors.

Allocation Breakdown

Here’s a look at how these funds were utilized across different city departments and services:

- Health & Welfare (21%)

A substantial chunk of the budget supports health initiatives and welfare programs designed to improve the well-being of citizens. These funds help manage public hospitals, mental health services, and social support mechanisms. - Education (27%)

Nearly a third of the tax revenue is dedicated to educational services. This ensures schools are funded, teachers are paid, and educational resources are provided to students across the city, aiming to secure a bright future for the younger generation. - Uniform Agencies (27%)

This portion supports essential services like police, fire departments, sanitation, and corrections. It ensures that these agencies have the resources necessary to maintain safety and order within the city. - Other Agencies (25%)

The remainder covers a variety of vital agencies that maintain infrastructure, housing, parks, and transportation. This allocation ensures that every aspect of city life runs smoothly, from keeping streets safe and transit systems efficient to maintaining recreational facilities.

By understanding this breakdown, you can see exactly how your tax contributions are distributed, supporting the vast network of city services that keep everything running smoothly.

Chapter 3: The Price You Pay for Living in the New

When you choose to live in a brand-new condo in New York City, you are not just paying for a place to live. You are investing in cutting-edge architecture, modern amenities, and the latest technology. These luxurious features come at a price, and that price is reflected in the taxes you pay. New development condos are often equipped with state-of-the-art facilities such as smart home systems, energy-efficient appliances, and high-end finishes. While these features enhance your living experience, they also contribute to the overall cost of the property and subsequently, the taxes you owe.

Tax Breaks and Benefits

Despite the higher tax rates associated with new development condos in NYC, there may be some relief available in the form of tax breaks and benefits. The government sometimes offers incentives to encourage investment in new construction properties. These incentives could include tax deductions for certain eco-friendly upgrades, exemptions for a period of time after the completion of the building, or even reduced property tax rates for a specific number of years. It’s essential to explore these potential benefits with your real estate agent or tax advisor to ensure you are taking advantage of all available opportunities to save on taxes.

| Neighborhood | Property Tax Rate (%) | Transfer Tax Rate (%) | Mansion Tax Rate (%) |

|---|---|---|---|

| Manhattan | 0.80% | 1.00% | 1.00% |

| Brooklyn | 0.90% | 1.425% | 1.25% |

| Queens | 0.90% | 1.425% | 0.25% |

| Bronx | 1.05% | 1.425% | 0.50% |

| Staten Island | 1.05% | 1.425% | 1.00% |

Chapter 4: How to Plan for Your New Condo Taxes

“When you purchase a new condo in NYC, you will receive a tax bill for the property. This bill includes important information about the taxes you owe on your new home. It’s essential to understand this document to effectively plan and budget for your taxes.

Your property tax bill will detail several critical components:

- Current and Past Due Property Tax Changes: These sections show any updates or outstanding amounts, providing a clear picture of your tax status.

- Other Property-Related Charges: Be aware of any additional fees connected to your property, ensuring you’re informed of all financial obligations.

- Exemptions or Abatements: If you qualify for any tax reductions, these will be listed, helping you accurately anticipate your tax liability.

- Overpayments or Credits: Check if there’s a credit balance or any refunded amount that could influence future payments.

- Discount for Early Payment: Take note of potential savings by paying your taxes early, encouraging timely payment.

- General Information on Tax Calculation: This section offers insight into how your taxes are determined, aiding in your overall understanding of the tax process.

Understanding each of these elements will empower you to manage your finances more effectively and ensure there are no surprises when it comes to your property taxes.”

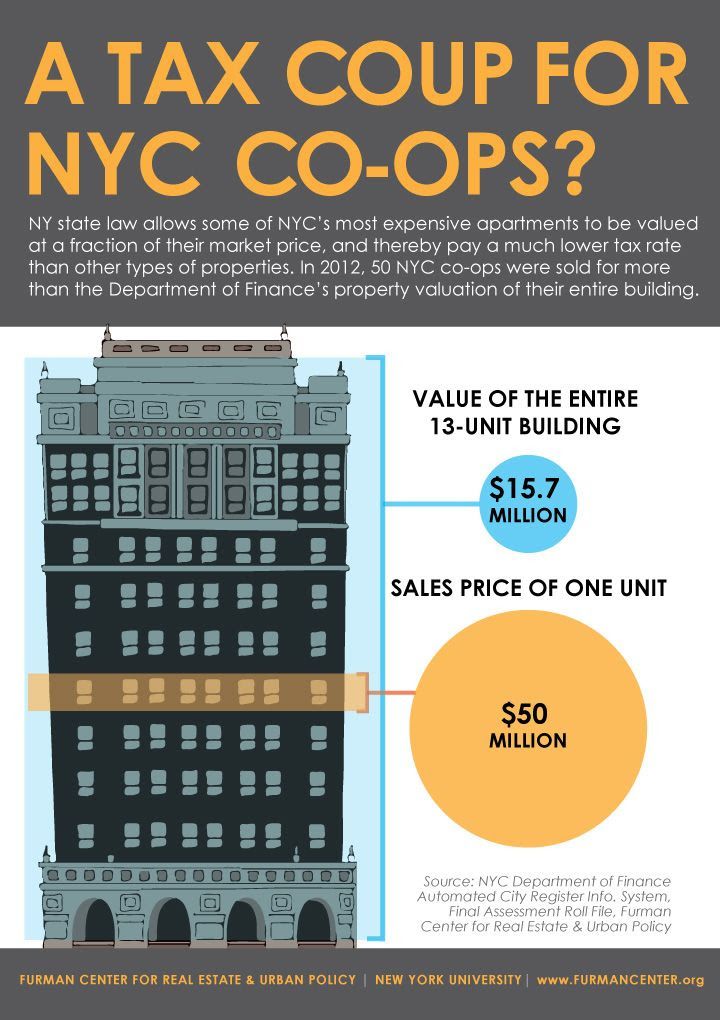

Image courtesy of furmancenter.org via Google Images

Image courtesy of furmancenter.org via Google ImagesStrategies to Save on Taxes

While taxes on new condo developments in NYC may be higher, there are strategies you can consider to potentially save on your tax bill.

1. Homestead Exemption: In some cases, you may qualify for a homestead exemption, which reduces the taxable value of your property and subsequently lowers your tax bill.

2. Appeals Process: If you believe that your property has been assessed incorrectly, you have the option to appeal the assessment. By providing evidence to support a lower assessment, you could potentially reduce your taxes.

3. Tax Incentives: Keep an eye out for any available tax incentives for new condo owners in NYC. Some programs may offer tax breaks or rebates that can help lessen the financial burden of property taxes.

4. Tax-Deferred Savings Accounts: Consider setting up a tax-deferred savings account specifically for your property taxes. By contributing regularly to this account, you can ensure that you have the funds available when tax bills are due.

By understanding your tax bill and implementing smart strategies to save on taxes, you can effectively plan for and manage the tax implications of owning a new condo in NYC.

Property Tax Billing and Payment Schedule for High-Value Properties

For properties assessed at over $250,000, property tax bills are issued twice a year. The billing occurs semi-annually, ensuring property owners know their financial responsibilities well in advance.

Billing and Payment Details:

- Frequency of Billing: Property tax bills are sent out two times annually.

- Payment Deadlines:

- First installment is due by July 1.

- Second installment needs to be paid by January 1.

By keeping a close eye on these dates, property owners can avoid late fees and maintain a smooth financial operation.

Conclusion: Getting Smart with Your New Condo

As we wrap up our exploration of tax rates on new condo developments in the vibrant city of New York, it’s crucial to emphasize the significance of being informed buyers. Understanding why taxes are higher on new construction condos in NYC and the factors that contribute to this increase can help you make smarter decisions when it comes to purchasing your dream home.

By delving into the differences between taxes on new buildings versus existing ones, you can gain a deeper insight into the financial implications of your investment. The cost of building a condo directly affects the taxes you’ll be paying, so being aware of these expenses can aid you in planning your budget effectively.

Living in a brand-new condo often comes with luxurious features and amenities that enhance your quality of life. However, these amenities also contribute to higher property taxes. Understanding these trade-offs can help you weigh the pros and cons of purchasing a new development condo in NYC.

By familiarizing yourself with your tax bill and exploring potential strategies to save on taxes, you can take proactive steps to minimize your financial burden in the long run. Planning ahead and budgeting for your new condo’s taxes can ensure that you’re financially prepared for the responsibilities that come with homeownership.

Ultimately, being smart with your new condo means staying informed, understanding the tax implications, and planning strategically for your financial future. With the knowledge and insights gained from this guide, you can navigate the world of new NYC condo taxes with confidence and make informed decisions that align with your long-term goals.

FAQs

Why are new condos in NYC taxed differently?

New condos in NYC are taxed differently because of the way the government assesses property taxes. When a new condo building is constructed, its value is often reassessed, leading to potentially higher taxes compared to older properties. Additionally, new condos may come with added amenities or features that increase their overall value, resulting in higher tax obligations.

Can I get tax breaks on my new condo?

Depending on certain factors, you may be eligible for tax breaks on your new condo in NYC. Some tax breaks or incentives are available for new construction properties to encourage homeownership and development. To find out if you qualify for any tax breaks, it’s best to consult with a tax professional or do some research on the specific programs that may apply to your situation.

How can I budget for my new condo’s taxes?

When budgeting for your new condo’s taxes, it’s important to consider the potential increase in property taxes compared to older properties. You can estimate your taxes by looking at the current tax rates and assessments in the area where your condo is located. It’s also a good idea to set aside some money each month for property taxes to ensure you’re prepared when the tax bill arrives.

Begin your search and start earning cash back!

Property tax bills for properties valued at $250,000 or less are mailed out every quarter. This means you’ll receive your bill four times a year, making it easier to manage your payments.

The due dates for these tax payments are set on a consistent schedule, helping you to plan ahead financially. You need to have your payment ready for the following dates:

- July 1

- October 1

- January 1

- April 1

Mark these dates on your calendar to ensure timely payments and avoid any late fees or penalties.

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach.

Our Comprehensive Services Include:

- Search Apts for Sale: Explore a wide range of available properties tailored to your preferences.

- Market Reports: Stay informed with the latest market trends and data to make educated decisions.

- Buyer’s Guide: Navigate the buying process with ease using our detailed guide.

- Find an Agent: Connect with experienced agents who understand your needs and local market intricacies.

- Market Data: Access comprehensive data to inform your buying or selling strategy.

- Selling Your Apartment: Receive expert advice and strategies to ensure a successful sale.

Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions.

Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

- What support is available for selling my apartment?

There is targeted assistance available for those looking to sell their apartments, ensuring you have the resources and support needed for a successful transaction.

- How can I find a real estate agent?

Utilize services that connect you with experienced real estate agents who can help you navigate the buying or selling process.

- Is there guidance available for buyers?

Yes, there is a dedicated buyer’s guide available that offers valuable information and tips to assist you throughout the purchasing process.

- What resources are available to understand the market?

Access comprehensive market reports and data that provide insights into current trends and conditions, helping you make informed decisions.

- How can I search for apartments for sale?

You can explore available properties through specialized search tools designed to help you find the perfect apartment for sale.

Image courtesy of via

Image courtesy of via