Discover the hidden costs behind new condo taxes – find out why you may be paying more than you thought.

Table of Contents

Introduction: The Scoop on Taxes for New Condos

Have you ever wondered why taxes on new condos can be higher than on older buildings? Well, get ready to dive into the world of taxes and new condo developments to uncover the reasons behind those numbers on your property bill!

Living in a new condo in a bustling city like New York City can come with its perks, but it also means understanding why taxes play a big role in the cost of your home. So, let’s break it down and see why taxes are a crucial part of the picture for new condo owners.

The Basics of Taxes and New Condos

Taxes are like a fee that we pay to the government to help run the city and provide services for everyone. When we pay taxes, we are helping to pay for things like schools, parks, roads, and even the people who keep us safe, like firefighters and police officers.

Why New Condos?

When people decide to build new condos, especially in busy cities like New York City, they often have to pay higher taxes. This is because building new homes costs a lot of money, and the taxes help cover those costs. So, if you see a fancy new condo building going up, the people who live there might have to pay more in taxes to help cover the expenses of creating those beautiful homes.

The Cost of Building New Condos

When it comes to building new condos, there are a lot of expenses that add up. Think about it like building a giant puzzle – each piece costs money! People building new condos have to pay for things like materials, like bricks and wood, and the workers who put everything together.

Image courtesy of www.linkedin.com via Google Images

Imagine going to a store and buying all the things you need to build a house. It’s not just an easy one-time purchase; it’s a big investment that involves planning and spending money at each step of the way.

Now, all these costs add up and eventually determine how much money needs to be collected in taxes. This is why taxes on new condos can be higher compared to older ones. The more it costs to build a condo, the more taxes may need to be paid to cover those expenses.

Understanding NYS Transfer Taxes

When dealing with property transfers in New York State, it’s important to know the applicable transfer tax rates, which vary based on both property type and price range. Here’s how they break down:

Condos, Co-ops, and 1-3 Family Houses:

- Properties under $3 million: A transfer tax rate of 0.40% applies.

- Properties worth $3 million or more: The tax rate increases to 0.65%.

Other Property Types:

- Properties under $2 million: Here, a tax rate of 0.40% is enforced.

- Properties exceeding $2 million: The rate escalates to 0.65%.

By understanding these rates, property buyers and sellers can better anticipate the costs associated with transferring property ownership in New York State.

Tax Implications of Investing in New York City Real Estate

Investing in real estate, such as purchasing property in New York City, can be highly advantageous, but it comes with specific tax implications that investors should be aware of.

Tax Deductions on Mortgage Interest

One of the primary benefits of investing in NYC real estate is the ability to deduct mortgage interest. For investment properties, all mortgage interest paid is fully deductible. This can significantly reduce your taxable income, enhancing the profitability of your investment.

Limitations on Loan Fees

However, there are some limitations to be mindful of. Loan origination fees and points, often paid to reduce a loan’s interest rate, are not deductible. This means investors need to consider these costs as they impact overall profitability.

Caps on Deductible Interest

Interest from loans used for purchasing, building, or improving a property is deductible with specific caps. Single taxpayers can deduct up to $750,000 in mortgage interest, while married couples filing jointly can deduct up to $1,000,000. These figures are especially relevant in a high-cost market like NYC.

Additionally, interest on home equity loans has its own limitations. Individuals can deduct up to $50,000, and married couples up to $100,000. Keep these figures in mind as they can affect how you leverage your properties for further investments.

Other Considerations

Keep in mind the local and state tax regulations of New York, which may impose additional taxes on property transactions. Understanding both federal and state tax implications can help in maximizing the returns on your real estate investment.

Navigating these tax rules can be complex, so consulting with a local tax advisor or real estate accountant may be beneficial to ensure all deductions are appropriately claimed, and potential tax liabilities are minimized.

Understanding the complexities of tax exemptions when selling real estate can be daunting. Consulting an accountant is crucial because these professionals bring a wealth of expertise and up-to-date knowledge of ever-changing tax laws.

An accountant can assess your specific situation, identifying which exemptions you may qualify for, such as the primary residence exclusion or various capital gains reliefs. They can also clarify potential savings and ensure that you are compliant with all regulations, thus minimizing the risk of costly mistakes.

By leveraging their insights, you can strategize effectively, making well-informed decisions that maximize your financial outcomes. In essence, an accountant acts as your guide through the complex tax landscape, turning potential pitfalls into opportunities for savings.

Understanding Limited Liability Companies (LLCs) in New York City Real Estate

A Limited Liability Company, or LLC, is a flexible business structure that combines the benefits of corporations and partnerships. It is an ideal choice for individuals looking to collaborate on specific projects without committing to long-term partnerships. In the context of New York City real estate, LLCs offer unique advantages for property investment and management.

Key Benefits of an LLC in Real Estate

- Asset Protection: One of the primary benefits of an LLC is its ability to protect personal assets. Members (or owners) of the LLC are not personally liable for the company’s debts or liabilities. This makes it an attractive option for those investing in high-value real estate.

- Tax Advantages: LLCs provide a flexible tax structure. In certain cases, such as transferring property title to the LLC, investors can potentially mitigate taxes associated with selling real estate.

- Operational Flexibility: An LLC offers greater operational flexibility compared to other business types. Members can define their own management structure and operating procedures, which is crucial in the dynamic real estate market of New York City.

- Ease of Transfer: When real estate is purchased through an LLC, transferring ownership can be more straightforward. Members can choose to transfer the property’s title within the LLC, simplifying processes during sales or changes in ownership.

LLC Use Case in NYC Real Estate

Consider a group of investors buying a property in Manhattan. By forming an LLC, they can pool resources while enjoying limited liability. Once they acquire the property, they can decide to place the title under the LLC’s name. This not only streamlines management but also offers potential tax efficiencies when the property is sold or transferred.

In summary, forming an LLC is a strategic decision for real estate endeavors in New York City, offering protection, tax benefits, and operational agility for investors aiming at project-specific investments.

What Are “Unforeseen Circumstances” for IRS Tax Exemption?

When it comes to qualifying for a tax exemption, “unforeseen circumstances” play a crucial role. The IRS describes these as events that could not have been reasonably predicted before purchasing and living in your primary residence.

Common Examples of Unforeseen Circumstances

- Disasters and Emergencies:

- Natural disasters like hurricanes or earthquakes.

- Human-made crises including war and terrorism.

- Personal Life Changes:

- A significant shift in employment, such as job loss, which affects your ability to cover living costs.

- Life-altering personal situations like divorce or separation.

- Sudden and tragic events, such as death or unexpected multiple births from one pregnancy.

For more comprehensive insights, IRS Publication 523 provides an in-depth explanation of these “unforeseen circumstances.” This guide is invaluable for anyone looking to understand tax exemption eligibility under these special conditions.

Taxes for Non-US Residents Selling Property in NYC

When non-US residents decide to sell property in New York City, they face a unique tax landscape designed to ensure compliance with federal and state regulations. Here’s a breakdown of what these sellers can expect:

Federal and State Taxes

- Federal Taxes: At the federal level, non-US residents are subject to a withholding tax on the sale’s proceeds. This is part of the Foreign Investment in Real Property Tax Act (FIRPTA), where the IRS holds a portion of the sale to guarantee tax payment. Currently, this withholding is set at 10%, but it may vary depending on updated regulations or specific circumstances.

- State Taxes: In addition to federal requirements, New York State imposes its own tax on property sales. This state withholding is currently fixed at 6.85%.

Combined Impact

The combined effect of these federal and state withholdings results in a significant tax rate when non-US residents sell their NYC property, totaling approximately 16.85%.

Filing Obligations

To navigate this process efficiently, sellers or buyers must file the necessary paperwork with the IRS. This involves submitting a “Statement of Withholding on Disposition by Foreign Persons of United States Real Property Interests” form to report the transaction and the relevant tax withholdings.

Strategies to Mitigate Taxes

Some foreign investors create a Limited Liability Company (LLC) to handle property transactions, which can offer potential tax advantages and a more streamlined process, depending on specific legal and financial conditions.

By understanding these regulations, non-US residents can be more prepared when engaging in the New York City real estate market.

Life in a New Condo Development

Living in a new condo development in New York City is an exciting experience. Imagine walking into a brand-new building, with shiny floors, sparkling countertops, and the smell of fresh paint in the air. It’s like moving into a modern masterpiece!

Benefits of New Condos

One of the best things about living in a new condo is that everything is fresh and new. You get to be the first person to live in your space, making it truly your own. From high-tech appliances to energy-efficient features, new condos are designed with the latest technology and comforts in mind.

Understanding Capital Gains for Primary Residence Sellers in New York City

Capital gains represent the profit realized from selling a property, calculated as the difference between the selling price and the purchase price of the home. For homeowners selling a primary residence in New York City, understanding how these gains are taxed is crucial.

Taxation on Capital Gains

- Federal and State Taxes: In the United States, capital gains tax is generally 15% for most residents. However, New Yorkers also face additional city taxes, adding roughly 10% more to the total tax burden.

- Holding Period: The duration for which the property is owned matters significantly:

- Short-Term Capital Gains: If the property is sold within one year or less, it is categorized as a short-term capital gain, typically taxed at higher rates.

- Long-Term Capital Gains: Properties owned for over a year qualify for long-term capital gains, which usually enjoy lower tax rates.

- Exemptions and Deductions: Sellers can sometimes exclude a significant portion of the gain from taxation:

- The exclusion can be up to $250,000 for single filers and $500,000 for married couples, provided the home was used as a primary residence for at least two of the last five years.

- Deductible expenses might include closing costs, loan application fees, and discount points for securing a favorable mortgage rate.

Reporting Capital Gains

All capital gains must be reported on Schedule D of the IRS tax form. Proper categorization between short-term and long-term gains is crucial for accurate tax filing.

Strategic Selling Tips

- If possible, sellers should aim to live in their property for more than two years before selling. Doing so not only increases the likelihood of higher tax exclusions but also offers more flexibility for reinvesting the proceeds.

By understanding these aspects, primary residence sellers in New York City can make informed decisions, optimizing their profits while minimizing tax liabilities.

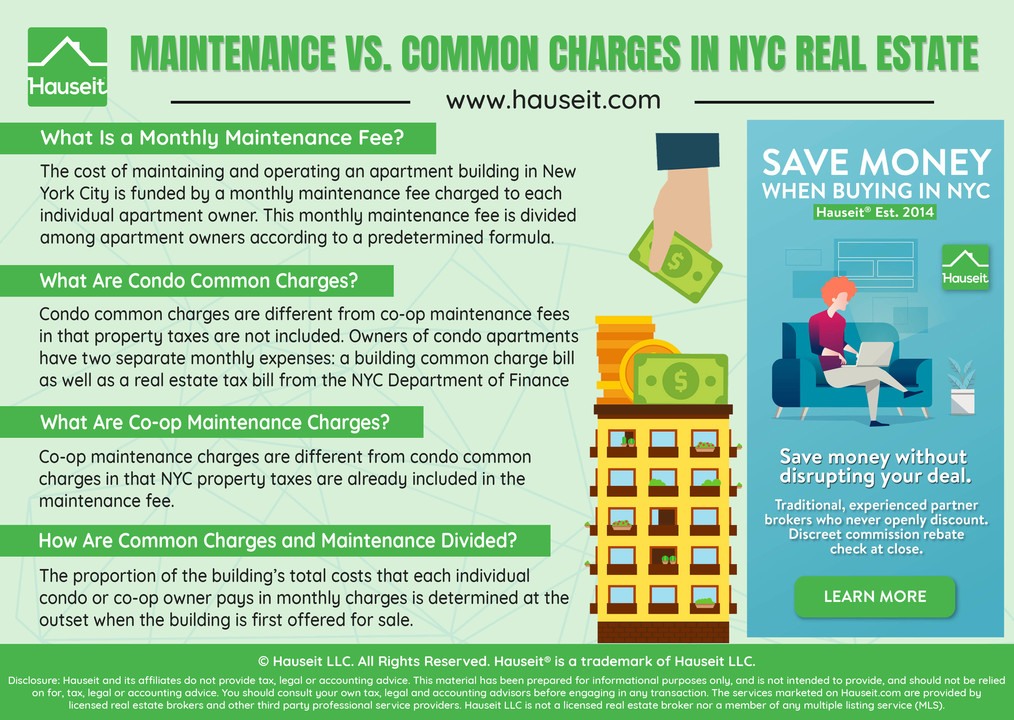

Comparing Old and New Condos: A Tax Tale

When it comes to comparing old condos with new ones, one significant factor that can affect taxes is the age of the building. Older buildings may have lower taxes compared to brand-new constructions. But why is that?

| Reasons for Taxes on New Condos | Explanation |

|---|---|

| 1. Development Costs | New condos require infrastructure improvements and services, which are funded through taxes. |

| 2. Maintenance and Repairs | Taxes help cover the cost of maintaining and repairing public areas surrounding new condos. |

| 3. Public Services | Taxes contribute to funding public services such as schools, roads, and emergency services. |

| 4. Community Benefits | Taxes support community programs and initiatives that benefit residents of new condos and surrounding areas. |

Image courtesy of www.postcrescent.com via Google Images

Image courtesy of www.postcrescent.com via Google ImagesOlder buildings have often had their property taxes assessed based on the value of the property at the time it was built. This means that as the property ages, the taxes may not increase as much compared to a new condo where taxes are typically based on the current market value.

Additionally, older buildings may have already paid off certain construction costs or debts related to the building’s development, leading to potentially lower taxes for residents.

Despite the charm and character of older condos, new constructions in bustling cities like New York City often come with higher taxes due to the modern amenities, advanced technologies, and increased desirability of being the first owner in a brand-new space. So, while older condos may offer a tax break, new condos can provide a fresh and exciting living experience that comes at a higher cost.

Understanding NYC Real Estate Taxes: Obligations and Exemptions

Selling real estate in New York City involves navigating a complex landscape of tax obligations and potential exemptions. Here’s a breakdown of what sellers need to know:

Investment Property Taxes

Real estate investment can be lucrative, but it’s essential to understand the tax implications. All mortgage interest on investment properties is typically tax-deductible. However, you cannot deduct loan origination fees and points used to secure a lower interest rate.

Interest deductions for properties are capped at $500,000 for single filers and $1,000,000 for married couples. Additionally, home equity loan interest can be deducted up to $50,000 for individuals and $100,000 for joint filers.

Capital Gains Taxes

Capital gains tax applies to the profit made from selling a property. The tax rate often stands at 15% federally for NYC residents, with an additional city tax of about 10%.

To potentially avoid capital gains tax, the property must have been your primary residence for at least two out of the last five years. Single filers can exclude up to $250,000 in gains, while married couples can exclude up to $500,000. Long-term capital gains are preferred, as properties held for over a year benefit from lower tax rates.

Non-U.S. Residents

Non-U.S. Residents selling NYC property face specific tax withholding regulations. The Foreign Investment in Real Property Tax Act (FIRPTA) mandates withholding 30% of the sale price for federal and state taxes. New York State withholds 6.85%, and the IRS holds back another 10%. FIRPTA compliance involves filing a particular IRS form during the transaction. Alternatively, non-U.S. Investors might consider setting up a Limited Liability Company (LLC) to potentially mitigate tax exposure.

Tax Exemptions

Certain circumstances allow sellers to qualify for tax exemptions:

- If forced to sell due to unpredictable events, like a sudden job relocation or severe health issues, you may be eligible for an exemption.

- “Unforeseen circumstances,” such as natural disasters, divorce, or changes in employment, qualify for unique tax relief as detailed in IRS Publication 523.

- Military members have extended timelines of up to 10 years to benefit from primary residence exemptions.

Lastly, one can defer capital gains by purchasing a “like-kind” or similar valued property within 180 days of the sale, known as a 1031 exchange, provided the new property is in the U.S. Mainland.

Consultation with a tax professional or accountant is advised to navigate these complexities and determine applicable exemptions for your situation.

Understanding NYC Transfer Taxes by Property Type and Price Range

Navigating the intricacies of New York City’s transfer taxes can be daunting, especially given the varying rates for different property types and value brackets. Here’s a breakdown to help you understand what to expect when buying or selling property in NYC:

- Condos, Co-ops, and 1-3 Family Houses:

- For properties priced at $500,000 or below, there’s a tax rate of 1%.

- If the property’s value exceeds $500,000, the tax rate increases to 1.425%.

- Other Property Types:

- Properties not falling under the residential categories mentioned above (such as commercial real estates) have a tax rate of 1.425% when valued at $500,000 or less.

- Should these properties be valued over $500,000, the tax rate jumps to 2.625%.

By understanding these percentages, you can better anticipate the additional costs associated with your property transaction in NYC.

Understanding New York City‘s Mansion Tax Rates

If you’re considering purchasing luxury real estate in New York City, it’s crucial to understand the mansion tax rates that apply to various property price ranges. Here’s a clear breakdown:

- $1,000,000 to $1,999,999: You’ll incur a tax rate of 1%.

- $2,000,000 to $2,999,999: A slightly higher rate of 1.25% is applicable.

- $3,000,000 to $4,999,999: The tax increases to 1.5%.

- $5,000,000 to $9,999,999: Purchases in this range are taxed at 2.25%.

- $10,000,000 to $14,999,999: A 3.25% rate applies to these luxury properties.

- $15,000,000 to $19,999,999: The tax rate rises to 3.5%.

- $20,000,000 to $24,999,999: You’ll face a tax rate of 3.75%.

- $25,000,000 and above: Properties in this elite range are taxed at the highest rate of 3.90%.

This tax structure aims to accommodate varying levels of luxury property purchases, with higher rates as property values increase.

Exploring the Tax Benefits of a Mortgage in New York City

Owning a property in New York City comes with more than just a prestigious address—it can also offer notable tax benefits through your mortgage. Here’s how having a mortgage can positively affect your tax situation:

1. Mortgage Interest Deduction

One of the primary tax perks of having a mortgage is the ability to deduct interest payments. In New York City, you can subtract mortgage interest from your taxable income, which can reduce the total amount of income subject to taxation. This deduction is especially valuable in high-cost areas, like NYC, where mortgage interest payments can be substantial.

2. Property Tax Deduction

Alongside mortgage interest, homeowners can often deduct property taxes from their federal income taxes. For New York City homeowners, property taxes paid can be itemized and deducted, providing a further reduction in taxable income.

3. Potential State and Local Tax Deductions

New York State provides its own set of deductions and credits for property owners. While the federal deduction for state and local taxes (SALT) is capped, you should explore any additional local benefits with a qualified tax advisor, tailored to your specific situation in NYC.

Important Considerations

While these advantages are beneficial, it’s crucial to be aware of current tax laws and any changes that might affect deduction limits. Keep in mind that the Tax Cuts and Jobs Act of 2017 introduced limitations on the amount of interest and property taxes you can deduct, so consulting with a tax professional or accountant who understands New York City’s unique tax landscape is highly recommended.

In summary, having a mortgage on a property in NYC can offer a host of tax benefits, primarily through deductions on mortgage interest and property taxes. By leveraging these, you may significantly lower your taxable income, making homeownership even more appealing in the city that never sleeps.

How Does the Duration of Property Ownership Affect Capital Gains Reporting?

Understanding how the length of time you own a property influences your Capital Gains report is critical for tax planning. The IRS treats property ownership duration differently, impacting whether your gains are categorized as short-term or long-term.

Short-Term vs. Long-Term Capital Gains

- Short-Term Capital Gains: If you hold a property for one year or less, any profit from its sale is considered short-term. These gains are typically taxed at your regular income tax rate, which can be higher than long-term rates.

- Long-Term Capital Gains: Owning a property for more than one year before selling it qualifies your profit as a long-term Capital Gain. These gains benefit from reduced tax rates, making them more favorable.

Strategic Ownership for Tax Benefits

To maximize tax advantages, consider residing in your property for over two years before selling. This strategy allows you to forego a portion of the capital gains tax, thanks to exemptions on primary residences, subject to certain conditions. The extra time not only aids in reducing tax burdens but also provides flexibility for reinvestment opportunities.

In summary, the duration of property ownership has significant implications for Capital Gains taxation, influencing whether profits are treated as short-term or long-term gains and affecting the overall financial outcome of your sale.

To qualify for a Capital Gains tax exemption on your primary residence, there are specific conditions you need to meet:

- Ownership Duration: You must have owned the home for at least two years within the past five years before selling it.

- Primary Residence Usage: The house should have been your main home for at least two of the five years leading up to the sale. These years do not need to be consecutive.

- Maximum Exemption Limits: The exemption allows you to exclude up to $250,000 of profit from taxation if you are single, and up to $500,000 if you are married and file jointly.

- Frequency of Use: This exemption is available once every two years. You cannot claim the exclusion on more than one sale within a two-year period.

By meeting these criteria, you can potentially avoid taxes on a significant portion of your gains from selling your primary residence.

How Mortgage Interest Impacts Tax Deductions on Investment Properties

Investing in real estate offers several tax advantages, one of the most notable being the ability to deduct mortgage interest. When you own investment property, the interest you pay on the mortgage can be fully deducted from your taxable income. This deduction can significantly reduce your overall tax liability, making property investment an attractive option for many.

However, there are some limitations to keep in mind. While mortgage interest is deductible, costs associated with securing the loan are not automatically eligible for deduction. Specifically, loan origination fees and points paid to secure a lower interest rate on the mortgage can’t be deducted in the same year. These costs must be amortized over the life of the loan, meaning you can only deduct a fraction of them each year.

Understanding these nuances ensures you can make the most of your real estate investments from a tax perspective, turning potential liabilities into assets.

Wrapping it Up: Understanding Condo Taxes

So, now we know why taxes on new condos can be higher than those on older buildings. It all comes down to the cost of building these brand-new homes and the expenses that come with it. When developers construct new condos, they have to pay for materials, labor, and many other things, which can drive up the overall cost. And since property taxes are based on the value of the property, these higher costs can lead to higher taxes.

Living in a new condo in a city like New York can be exciting, with all the modern amenities and features they offer. However, it’s essential to understand that these conveniences come at a price – higher taxes. But don’t let that discourage you! With proper planning and budgeting, you can still enjoy the perks of a new condo while managing your tax expenses.

How Purchasing a “Like-Kind” Property Can Help Avoid Capital Gains Taxes

Purchasing a “like-kind” property can be a strategic way to defer capital gains taxes. Here’s how this works:

- What is a “Like-Kind” Exchange?

- A “like-kind” exchange is part of what’s known as a 1031 exchange, as defined by the IRS. It allows property investors to defer paying capital gains taxes on an investment property when it’s sold, as long as another similar property is purchased.

- Conditions to Qualify:

- To qualify, the new property must be of equal or greater value than the sold property.

- The new property should be identified within a 45-day window after the sale of the original property.

- The closing of the new property must occur within 180 days of selling the old property.

- Geographical Limits:

- The replacement property must be located within the continental United States to be eligible for this exchange.

- Administrative Requirements:

- Proper forms must be filed with the IRS to notify them of the exchange and to maintain tax deferral benefits.

By adhering to these guidelines, you can potentially avoid immediate capital gains taxes, allowing those funds to be reinvested into the new property. This method can be highly beneficial for investors looking to grow their portfolios without an immediate tax burden.

How Military Obligations Influence Capital Gains Tax Exemptions

Military personnel have unique provisions when it comes to capital gains tax exemptions, allowing for greater flexibility in homeownership circumstances.

Key Exemptions for Military Members

- Residency Requirement Adjustment: Generally, to qualify for capital gains tax exemptions, homeowners must have lived in their property for at least two years. However, military service members are exempt from this residency requirement. This means they do not have to live in their home for the specified two-year period to benefit from these tax exemptions.

- Extended Ownership Period: Typically, homeowners need to own their property for at least five years to be eligible for capital gains tax benefits. For those in active military service, this period is extended to ten years. This adjustment acknowledges the unpredictable nature of military obligations which could require service members to move frequently.

Why These Provisions Matter

The nature of military service often forces personnel to relocate, sometimes at short notice. These tax provisions ensure that fulfilling their duties doesn’t disadvantage military members financially in terms of real estate investment and ownership. By understanding these exemptions, military personnel can make more informed decisions about buying or selling homes without the usual concerns of tax penalties associated with capital gains.

In essence, these special considerations provide a financial safeguard for military members, enabling them to serve their country without detriment to their personal financial investments.

How Non-US Residents Can Minimize Taxes When Engaging in Real Estate Transactions in New York City

Navigating the nuances of US tax laws is crucial for non-US residents involved in buying and selling real estate in New York City. Here’s how you can potentially minimize the hefty tax liabilities:

Understanding Tax Implications

When a non-US resident sells property in New York after owning it for over a year, there’s a significant tax implication due to federal and state laws.

- Federal and State Tax Withholding: You might face a combined withholding of 16.85% on the sales price. This consists of approximately 6.85% for New York State taxes and an extra 10% withheld by the IRS under the Foreign Investment in Real Property Tax Act (FIRPTA).

Strategy to Mitigate Taxes

To reduce tax burdens, some foreign investors leverage legal structures like creating a Limited Liability Company (LLC).

- Forming an LLC:

- By forming an LLC within the US, you can potentially shield yourself from direct taxation since the entity and not the individual is recognized as the property owner.

- LLCs provide flexibility and generally, profits can be passed through to its owners, possibly lowering effective tax rates.

Compliance Requirements

- Withholding Documentation: Upon selling, either party (buyer or seller) must submit a Statement of Withholding on Disposition by Foreign Persons of United States Real Property Interests to the IRS.

Understanding these mechanisms and seeking guidance from a tax professional can be beneficial in effectively managing and possibly reducing the taxes involved in your real estate ventures in New York City.

FAQs: Questions Kids Might Ask

What Are Taxes and Why Do We Have to Pay Them?

Taxes are like a fee that we pay to the government to help fund things like schools, roads, and parks in our city. When we buy things or own a home, we pay taxes to support our community!

Why Are Taxes Higher on New Condos?

When new condos are built, they cost a lot of money for things like materials, labor, and fancy features. Because of these costs, the taxes on new condos can be higher than older ones.

Why Do People Choose to Live in New Condos?

Living in a new condo can be exciting because you get to be the first owner of a brand-new home with all the latest designs and cool amenities like a pool or a gym right in the building!

Do Older Condos Have Lower Taxes?

Yes, sometimes older condos might have lower taxes because they were built a long time ago and may not have as many expensive features as new condos. It really depends on the building!

Begin your search and start earning cash back!

Work with the Real Estate Rebate Team

Real Estate Rebates Team is a top real estate brokerage firm in NYC and NJ, dedicated to delivering exceptional service and significant savings. Offering up to a 2.5% commission rebate at closing, we pass these savings directly to clients buying or selling homes. Through education and a transparent rebate system, we empower clients to maximize their benefits, with numerous success stories proving our approach.

Our Comprehensive Services Include:

- Search Apts for Sale: Explore a wide range of available properties tailored to your preferences.

- Market Reports: Stay informed with the latest market trends and data to make educated decisions.

- Buyer’s Guide: Navigate the buying process with ease using our detailed guide.

- Find an Agent: Connect with experienced agents who understand your needs and local market intricacies.

- Market Data: Access comprehensive data to inform your buying or selling strategy.

- Selling Your Apartment: Receive expert advice and strategies to ensure a successful sale.

Our online platform allows you to easily calculate potential rebates and find properties that suit your needs. We negotiate the best prices and secure additional incentives at closing, ensuring you get money back whether selling, renting, or buying a condo, co-op, or townhouse. For new developments, we offer even higher rebates on larger commissions.

Real Estate Rebates Team helps clients enjoy greater savings and better returns on their real estate transactions.

- What support is available for selling my apartment?

There is targeted assistance available for those looking to sell their apartments, ensuring you have the resources and support needed for a successful transaction.

- How can I find a real estate agent?

Utilize services that connect you with experienced real estate agents who can help you navigate the buying or selling process.

- Is there guidance available for buyers?

Yes, there is a dedicated buyer’s guide available that offers valuable information and tips to assist you throughout the purchasing process.

- What resources are available to understand the market?

Access comprehensive market reports and data that provide insights into current trends and conditions, helping you make informed decisions.

- How can I search for apartments for sale?

You can explore available properties through specialized search tools designed to help you find the perfect apartment for sale.

Qualifying for a Tax Exemption When Selling Your Primary Residence

When it comes to selling your primary residence, various conditions can make you eligible for a tax exemption. Understanding these can save you a significant amount of money.

Primary Residence Ownership and Unavoidable Circumstances

First and foremost, if you’ve owned and lived in your home as your primary residence for at least two years, but you’re forced to sell due to unavoidable circumstances, you may qualify for a tax exemption. These unavoidable situations include:

- Job relocation

- Health-related reasons

- A need to raise funds for unforeseen medical expenses

In cases related to health, it might be helpful (though not mandatory) to keep a physician’s letter that details your health issue, should future audits occur.

Unforeseen Circumstances

The IRS recognizes “unforeseen circumstances” as another route to qualify for a tax exemption. These are events you couldn’t have predicted before buying and living in your home. Applicable situations include:

- War or acts of terrorism

- Natural disasters

- Divorce or separation

- Death of a family member

- Multiple births from a single pregnancy

- A significant change in employment affecting your financial stability

For more information, you can consult IRS Publication 523, which elaborates comprehensively on unforeseen circumstances.

Special Provisions for Military Personnel

For those serving in the military, special rules apply. Since 2003, members of the army, navy, and National Guard aren’t required to meet the two-year residency prerequisite. Additionally, the ownership period extends from five to ten years, providing more flexibility for those fulfilling military duties.

By understanding these scenarios, you can better determine if you qualify for a tax exemption when selling your primary residence and make informed decisions regarding your property.

Image courtesy of via

Image courtesy of via